Not known Facts About Custom Private Equity Asset Managers

Wiki Article

Some Of Custom Private Equity Asset Managers

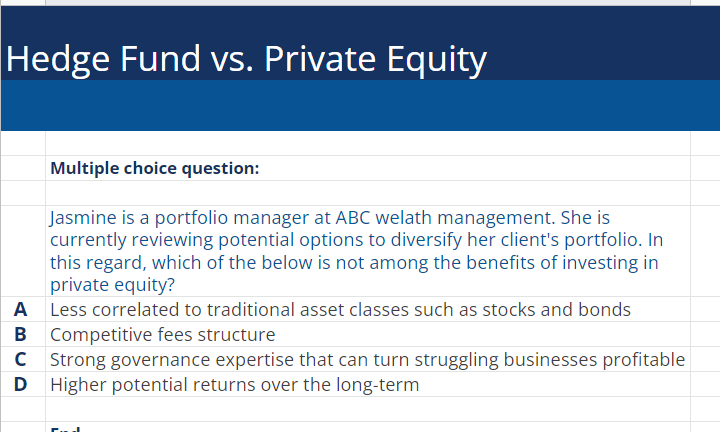

(PE): spending in firms that are not publicly traded. Approximately $11 (https://cpequityamtx.creator-spring.com). There may be a few points you don't comprehend regarding the industry.

Companions at PE companies elevate funds and take care of the money to yield beneficial returns for investors, usually with an investment horizon of between four and 7 years. Private equity firms have a variety of investment choices. Some are strict financiers or easy capitalists wholly depending on administration to grow the firm and generate returns.

Because the ideal gravitate towards the bigger offers, the middle market is a significantly underserved market. There are extra sellers than there are highly seasoned and well-positioned financing professionals with considerable customer networks and sources to handle an offer. The returns of private equity are generally seen after a few years.

Rumored Buzz on Custom Private Equity Asset Managers

Flying below the radar of large multinational companies, much of these small business often provide higher-quality customer support and/or particular niche products and solutions that are not being offered by the huge empires (https://medium.com/@madgestiger79601/about). Such upsides bring in the rate of interest of private equity firms, as they have the insights and wise to manipulate such chances and take the company to the following level

Private equity capitalists need to have reputable, capable, and reputable administration in position. A lot of managers at portfolio companies are provided equity and bonus compensation frameworks that award them for striking their monetary targets. Such placement of goals is generally called for before an offer obtains done. Personal equity possibilities are typically unreachable for people that can not invest countless bucks, but they should not be.

There are laws, such as limits on the aggregate amount of money and on the number of non-accredited investors (Syndicated Private Equity Opportunities).

3 Easy Facts About Custom Private Equity Asset Managers Explained

One more disadvantage is the absence of liquidity; when in a private equity purchase, it is not simple to leave or market. There is a lack of flexibility. Exclusive equity likewise comes with high fees. With funds under monitoring already in the trillions, private equity companies have come to be attractive financial investment automobiles for wealthy people and institutions.

For decades, the characteristics of exclusive equity have actually made the possession class an eye-catching recommendation for those that might participate. Since accessibility to private equity is opening as much as even more individual financiers, the untapped capacity is coming to be a reality. So the concern to take into consideration is: why should you invest? We'll start with the main arguments for purchasing personal equity: Just how and why exclusive equity returns have historically been greater than other possessions on a variety of degrees, Just how including exclusive equity in a profile impacts the risk-return account, by assisting to expand versus market and intermittent risk, Then, we will describe some key factors to consider and dangers for exclusive equity financiers.

When it pertains to presenting a brand-new possession right into a profile, the most standard factor to consider is the risk-return account of that possession. Historically, private equity has exhibited returns comparable to that of Arising Market Equities and greater than all other traditional possession courses. Its reasonably low volatility combined with its high returns creates an engaging risk-return profile.

The Facts About Custom Private Equity Asset Managers Revealed

Personal equity fund quartiles have the best range of returns across all alternative property classes - as you can see below. Methodology: Inner rate of return (IRR) spreads determined for funds within vintage years independently and after that balanced out. Average IRR was computed bytaking the standard of the median IRR for funds within each vintage year.

The result of adding exclusive equity into a profile is - as always - dependent on the profile itself. A Pantheon study from 2015 suggested that including exclusive equity in a portfolio of pure public equity can unlock 3.

On the other hand, the ideal private equity companies have accessibility to an also larger pool of unknown chances that do not encounter the very same scrutiny, as well as the resources to do due diligence on them and determine which deserve spending in (Private Investment Opportunities). Spending at the first stage suggests greater threat, but also for the firms that do prosper, the fund gain from greater returns

Custom Private Equity Asset Managers Can Be Fun For Anyone

Both public and personal equity fund supervisors devote to spending a percent of the fund yet there remains a well-trodden issue with aligning rate of interests for public equity fund administration: the 'principal-agent issue'. When a financier (the 'primary') employs a public fund supervisor to take control of their funding (as an 'agent') they pass on control to the supervisor while preserving possession of the properties.

additional readingIn the case of exclusive equity, the General Partner doesn't simply make an administration fee. Private equity funds additionally alleviate one more form of principal-agent trouble.

A public equity financier ultimately desires something - for the management to increase the supply price and/or pay returns. The investor has little to no control over the choice. We showed above the amount of personal equity techniques - specifically majority acquistions - take control of the operating of the company, making certain that the long-lasting worth of the business precedes, pressing up the return on investment over the life of the fund.

Report this wiki page